Unforeseen incidents and accidents are an unpleasant part of life, frequently resulting in financial hardship and psychological distress. Accident insurance is essential for reducing these risks since it offers financial assistance in the event that an accident results in injuries, impairments, or even death.

Additionally, loans like the UBL Car Loan, which enable you to purchase your ideal car without immediate financial stress, make managing financial goals like buying a car easier. In order to help you secure your future and realise your aspirations, this article examines the elements of the UBL Car Loan and the fundamentals of accident insurance.

Comprehending Accident Insurance

Accident insurance is a kind of coverage that provides people and their families with financial security in the event of unintentional harm, disability, or death. Accident insurance focuses on injuries brought on by accidents, as opposed to health insurance, which generally pays for medical costs associated with illnesses. Accident insurance coverage might vary, but generally speaking, it covers the following:

Medical Expenses:

The expense of treating injuries sustained in an accident is covered by accident insurance. This covers stays in hospitals, operations, and other required medical care.

Disability Benefits:

The insurance coverage may pay out if an accident leaves a person temporarily or permanently disabled. This is especially important for people whose capacity to work may affect their income.

Benefits for Accidental Death:

In the sad event that an accident results in death, the insurance policy pays the beneficiaries a lump sum amount. By paying for the funeral and offering support, this lessens the financial strain on the family.

Dismemberment Coverage:

Depending on the severity of the injury, accident insurance also pays for specific losses like losing one’s eyesight or limbs.

Income Replacement:

A portion of the policyholder’s income is guaranteed to be received while they recuperate from injuries and are unable to work thanks to certain plans’ income replacement benefits.

Why Is Accident Insurance Vital?

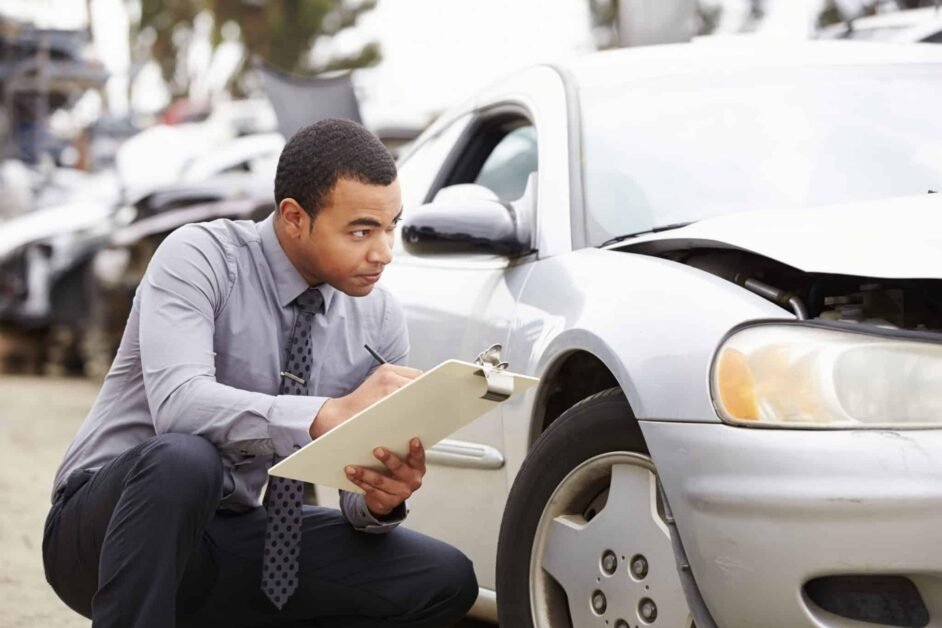

Accidents can have a large financial impact and are unpredictable. The expenses of medical care and rehabilitation may mount up rapidly following an accident—whether it’s a vehicle crash, a fall at home, or an incident at work. An injury can put their dependents’ financial security in jeopardy if they are the major breadwinners. Accident insurance acts as a safety net, minimising the financial burden on the family and guaranteeing that medical expenses are covered.

Furthermore, accident insurance can be obtained by people who might not have broad coverage because it is usually less expensive than full health insurance. It’s a crucial part of a comprehensive financial strategy, especially for people with dependents or high-risk jobs.

UBL Auto Loan: Making Your Dream of Owning a Car a Reality

Having a car represents independence, convenience, and advancement in lifestyle, making it a momentous occasion for many. The cash outlay necessary to buy a car, however, can be intimidating. This is where the UBL Car Loan enters the picture, providing a practical and adaptable means of funding your car purchase.

Important Aspects of the UBL Auto Loan

Flexible Financing Alternatives:

The UBL Auto Loan provides a variety of financing alternatives so you may select the one that best fits your budget. UBL offers alternatives to suit your needs, whether you’re searching for a shorter loan duration to pay off the automobile quickly or a longer tenure with reduced monthly instalments.

Competitive Interest Rates:

The UBL Auto Loan’s competitive interest rates are among its most alluring characteristics. This guarantees that your loan is within your means and that you won’t be saddled with excessive interest payments, which will make it simpler for you to manage your money while repaying the loan.

Large Selection of Vehicles:

You have the freedom to select the automobile that best suits your needs both financially and lifestyle-wise by using the loan to buy a wide range of vehicles, including both new and used models.

Fast and Simple Processing:

UBL guarantees a simple loan application procedure with prompt approval periods. This implies that you can enjoy the ease of instant access to your finances and drive off in your new car without having to wait around for long.

Comprehensive Insurance Coverage:

You can choose to have comprehensive auto insurance with a UBL automobile Loan, which can shield your automobile from theft, accidents, and other unanticipated circumstances. This offers peace of mind in addition to protecting your investment.

The most charming and sophisticated Karachi escorts provide an exclusive experience for those seeking luxurious companionship. Whether you’re attending a formal event or simply want to unwind, their services ensure a memorable and enjoyable time together.|

Sofern kein signifikanter dauerhafter Mangel

an Wachstumshormonen vorliegt, besteht aus medizinischer Sicht kein Grund dazu, auf eine entsprechende Therapie zu pochen.

Um deinen HGH-Spiegel also dennoch optimieren zu können, ohne dabei auf die hierzulande illegale Hilfe der Chemie zurückgreifen zu müssen, stehen dir

prinzipiell zwei Wege zur Auswahl. Erstens, hartes Krafttraining und

zweitens, eine ausreichende Menge an Schlaf.

Dass durch hartes Training vermehrt Wachstumshormone ausgeschüttet werden belegen sogar zahlreiche Studien renommierter

Universitäten.

Es ist verantwortlich für eine ganze Reihe von Körperfunktionen, -mechanismen und -prozessen wie Erholung, Reparatur von Zellgewebe,

Regeneration, Kontrolle des Stoffwechsels und Wachstums.

Jahrhunderts versucht wurde, dieses natürlich vorkommende

Hormon nachzuahmen. Bald darauf wurde die erste synthetische Model des Hormons von Kabi

Vitrum unter dem Handelsnamen „Somatropin” veröffentlicht.

Sofern ein Mangel vorliegt, wird dir dein Arzt helfen, andernfalls solltest du von der externen Zufuhr von Hormonen tunlichst die Finger lassen. Dies stellt mit an Sicherheit grenzender Wahrscheinlichkeit die Kardinalfrage dieser Thematik dar und ist in Anbetracht der Bedeutung,

die das HGH für den menschlichen Organismus hat, auch nachvollziehbar.

Zunächst einmal sollte dir bewusst sein, dass ein Mangel an Wachstumshormonen für dich persönlich

nur sehr schwer zu erkennen ist.

Vor allen Dingen Chlorella hat es in sich, denn dieses sorgt zudem für einen erhöhten Testosteronwert des Körpers.

Wie oben bereits erwähnt, stimuliert L-Arginin die Produktion von Wachstumshormonen. Um zeitgleich dem Testosteronspiegel etwas Gutes zu

tun, können Verbraucher zur Paranuss greifen. Somatropin oder hgh tabletten kaufen beispielsweise ist ein Wachstumshormon HGH, welches gerade

für Kinder von größter Wichtigkeit ist. Was jedoch auch Erwachsenen schmeckt sind Wassermelonen, die

eine hohe Menge an L-Citrullin enthalten.

Je nach Organismus sind zu diesem Zweck sieben bis neun Stunden Schlaf pro Tag erforderlich.

Die erhöhte Aufnahme von Wachstumshormonen im Bodybuilding kann adverse Auswirkungen haben. Durch die starke Förderung von HGH und

IGF-1 bestehen erhebliche Gefahren.

Darunter fallen unter anderem Kürbiskerne, Linsen, Pinienkerne, Walnüsse, Tomaten und grüne Bohnen. GABA kurz für Gamma Aminouttersäure ist ein weiteres Supplement

welches nachweislich die HGH Ausschüttung während dem Schlaf verbessern konnte.

Lediglich wenige Milligram reichen aus um eine signifikante Verbesserung zu erzielen.

Wenn Sie älter werden, verlangsamt die Hypophyse die Produktion des menschlichen Wachstumshormons.

L-Arginin, die auch bei Bluthochdruck genutzt

werden kann,(4) können die menschliche Wachstumshormon Produktion aber unabhängig von Ihrem Alter wieder in Gang setzen und so den Spiegel des Hormon verbessern, ganz ohne Steroide.

HGH wird in der Hirnanhangdrüse (Hypophyse) unseres Körpers produziert und hat mehrere Funktionen, die für unser Wachstum, unseren Körperbau und unsere Entwicklung von wesentlicher Bedeutung sind.

Dazu verlängern sich die Erholungszeiten nach dem Training – insbesondere nach einem harten Workout.

Somatropin wird Patienten zum Beispiel im Rahmen einer Wachstumshormon-Ersatztherapie gegeben(2).

In diesem Artikel erklären wir Ihnen, was Wachstumshormone genau sind, was sie bringen, wie eine Somatropin Kur aussieht und wie sie eine gute Various zu HGH Injektionen darstellen. → Verwalten Sie Ihre Laborwerte mit der Labor-App Blutwerte PRO – mit Lexikonfunktion.

Nicht nur, dass die Cortisolwerte auf Dauer ansteigen es wird auch die Freisetzung von anderen Hormonen wie Testosteron und HGH gehemmt.

Idealerweile sollte man deshalb weitgehend auf Zucker verzichten und stattdessen auf natürliche Süße wie Datteln, Bananen oder

Rosinen greifen. Diese haben eineVielzahl an wichtigen Nährstoffen und viele Ballaststoffe welche die Verdauung fördern und sich positiv den Insulin Spiegel auswirken. Zudem wirken sich diese

nicht nur negativ auf unsere Produktion auf Wachstumshormone aus sondern sind

schädlich für unsere allgemeine Gesundheit. Es gibt natürlich auch Lebensmittel die wichtige Nährstoffe wie L-Arginin und GABA enhalten bz.

Während seine Vorteile in bestimmten medizinischen Anwendungen unbestritten sind, werfen der Missbrauch und

die potenziellen Nebenwirkungen ernste ethische und gesundheitliche Fragen auf.

Die langfristige Sicherheit und Wirksamkeit dieser Anwendungen müssen weiterhin intensiv

erforscht werden. Es ist wichtig, dass solche Therapien nur unter strenger medizinischer Überwachung durch einen Arzt durchgeführt

werden, um mögliche Risiken zu minimieren und die besten Ergebnisse zu erzielen. Die Forschung in diesem

Bereich ist noch nicht abgeschlossen, und es bleibt abzuwarten, welche neuen Erkenntnisse die Zukunft bringen wird.

Es ist daher wichtig, auf eine ausgewogene und gesunde Ernährung zu achten, um die natürlichen Prozesse

im Körper zu unterstützen und die Produktion von Wachstumshormon zu optimieren.

Die 24-Stunden-Pulsrate des Wachstumshormons wurde zufällig und

häufiger während dieser wachen Stunden. Diese

Studie legt nahe, dass Schlafentzug die Wachstumshormonausschüttung am nächsten Morgen reduzieren und den Schlaf-Wach-Zyklus empfindlich stören und verändern kann.

Der Großteil der pulsierenden Sekretion von Wachstumshormonen findet kurz nach Beginn des Schlafes

statt und steigt weiter an, wenn die ersten Stunden des

Schlafes erreicht sind. Das Ergebnis war, dass sich die kognitive Funktion und die Stimmung nach

sechsmonatiger Therapie anhand von Stimmungsskalen signifikant verbesserten.

bodybuilding steroid

References:

is anabolic steroids legal (https://motionentrance.edu.np/profile/markbuffet9)

dianabol cycle before and after

References:

Valley.Md

hgh legal kaufen

References:

is hgh or Testosterone better, https://aparca.app/Ricklebron188,

steroids that help you lose weight

References:

Extreme Steroids (https://Git.Crudelis.Kr)

ipamorelin prescription requirements

References:

ipamorelin Mod grf 1-29 results pics

5mg ipamorelin reconstitution

References:

ipamorelin buy bulk (Erika)

sermorelin ipamorelin anti aging delivery

References:

ipamorelin for muscle injury Recovery

does cjc 1295 ipamorelin make you hungry

References:

Valley.Md